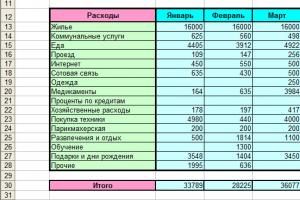

In order not to rack your brains over the question of where the money goes, and also to save effectively, you need to keep home accounting. This can be done in different ways: write down expenses and income in a notebook, and then summarize or use...

Read moreBudget

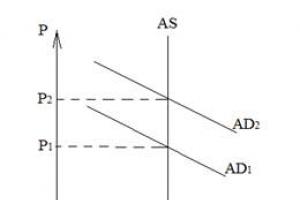

Classical and Keynesian approaches to the issue of macroeconomic equilibrium

The intersection of the aggregate demand and aggregate supply curves forms a macroeconomic equilibrium - the real volume of output at a certain price level. Keynesian and classical models are used here. 1. Keynesian model....

Read more

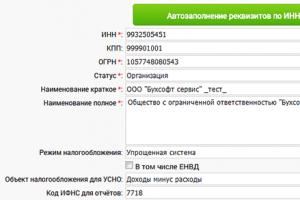

Key points of using the simplified tax system in Russia

Along with the general tax regime, the legislation provides for special tax regimes. These special regimes provide taxpayers with easier ways to calculate and pay taxes and submit tax reports. One of...

Read more

Usn income minus expenses, nuances and clarifications What can be written off expenses usn

05/10/2016 Taxpayers using the simplified tax system with the object “income minus expenses” have the right to reduce the tax base by the amount of expenses. But not any expenses can be written off, and only those that are mentioned in paragraph 1 of Article 346.16 of the Tax Code....

Read more

Success stories on how to save money

Learning to save money correctly is important for everyone, even those who receive a small salary. In order not to borrow until payday and to be rich, you need to follow simple rules. Most people in Russia today are financially illiterate. This...

Read more

Simplified tax system: advantages and disadvantages, types of simplification and application limitations

Simplified taxation or simplified taxation system is one of the taxation systems. It is “simplified” because you need to report once a year and calculate one tax. The simplified system comes in two types: “Income” or “STS 6%” and “Income minus expenses”, in other words - “STS...

Read more

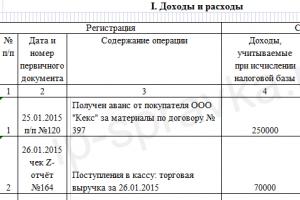

Filling out the book of income and expenses: section IV

Starting from 2013, all payers working on the simplified system use the form of the Book of Income and Expenses, approved by Order No. 135n dated October 22, 2012. For “simplified” people who take into account only income, this form provides a special...

Read more

Economic Council Main types of family expenses 11

This article will pay attention to the question of why multiple sources of income are needed and how they can be created. One salary is not enough. If the main sources of income are only salaries, then this is quite unstable...

Read more

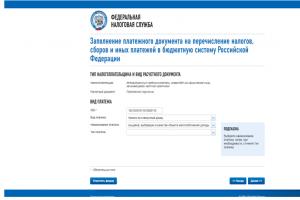

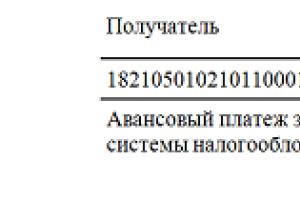

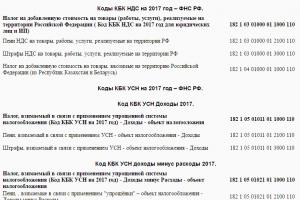

Code kbk usn income minus expenses

Every simplifier pays taxes to the budget using budget classification codes. BCCs can change at any time, so there is a question: which BCCs are currently relevant. In the article we will tell you what KBK is, how to use them and what KBK are for the simplified tax system...

Read more

How to get a loan for an unemployed person

There are often situations when you urgently need to get cash on the same day in Moscow, but there is no one to borrow money from. The only way out in this case is loans with a passport. Currently, a similar service...

Read more

KVR: transcript. What does KVR mean? Expense code 853 according to budget classification decoding

Expense type code 853 reflects the payment of other payments not classified as other subgroups and elements of CVR 800. Let's consider how CVR 853 is used in 2019 and what KOSGU codes it corresponds to. At the end of the article you can download the current...

Read more

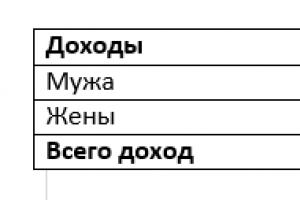

Planning and maintaining a family budget - how to save the family budget

How to plan a family budget correctly? Where to start planning a family budget? There are many questions regarding family budget planning. This is not a complicated science; it can and should be learned. Let's look at a simple example, we need to build...

Read more

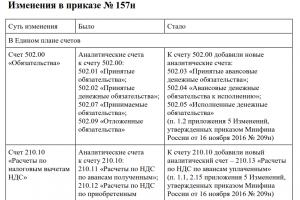

We work correctly: all instructions on budget accounting Instructions on accounting 174n

Order of the Ministry of Finance of the Russian Federation dated December 16, 2010 N 174n “On approval of the Chart of Accounts for accounting of budgetary institutions and Instructions for its application” Order of the Ministry of Finance of Russia dated December 31, 2015 N 227n introduced changes to the preamble that apply...

Read more

How to reduce VAT payable to the budget (optimization methods)

Controlling agencies believe that the amounts of penalties received by the seller from the buyer are measures of liability for violation of the deadlines for fulfilling obligations under the contract. Therefore, within the meaning of Article 162 of the Tax Code of the Russian Federation, they are not related to the implementation and...

Read more

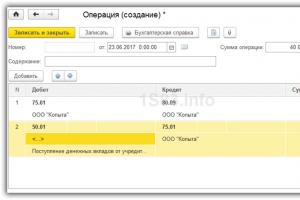

Reflection of the authorized capital in 1s 8

When the founders register an LLC, they need to contribute authorized capital. This can be either cash or property. It is the authorized capital that determines the minimum amount of the organization’s property that guarantees the interests of creditors. In this...

Read more

KBK VAT penalties for legal entities

BCC for VAT for 2016: payment of tax, refund of VAT from the budget, accrual of VAT penalties and fines >>> BCC for VAT for 2016 approved (as amended by order No. 90n dated June 8, 2015). KBK - necessary for grouping income, expenses and sources...

Read more